What is the Probability of Default in Credit Risk Management?

Discover the essential steps you should take to reduce credit risk and the importance of trade credit insurance for protecting your business.

Offering trade credit is a double-edged sword.

On one hand, it allows you to expand your customer base, encouraging new business and helping you to supply businesses who may not be in a position to pay up front.

On the other, offering credit comes with significant risks, be that in the form of customers defaulting or bad actors committing fraud.

When offering trade credit, you are betting on your customer's ability and willingness to pay. If they fail to meet their financial obligations, it will negatively impact your business, disrupting your cash flow and operations.

Fortunately, there are measures you can take to ensure that trade credit isn't a gamble. In this blog, we’ll discuss the probability of default, as well as some key steps you can take to help vet how financially sound a prospective customer is.

What is the probability of default?

Probability of default refers to the risk of whether a business will be able to repay their credit. This can be determined by analysing your potential customer's financial health, payment history, and industry stability.

A high probability of default means more significant risk for your business. It's important to understand the probability of default so you can make informed decisions about which companies to extend credit to and how to protect yourself.

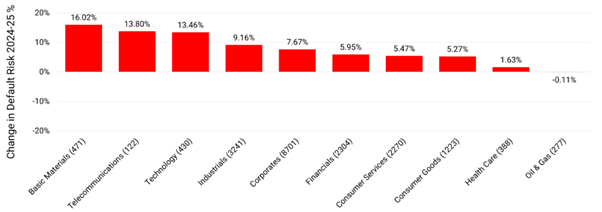

A 2024/25 UK Default Risk Forecast notes that default risks are predicted to plateau over the next 12 months, however they do report that the average probability of default varies depending on industry:

Understanding the probability of default for your industry helps you to evaluate potential risks before they become costly problems.

Vital pre-checks you should be doing before offering trade credit

Before offering trade credit, it's critical that you check the legitimacy of any potential customer. Without carrying out due diligence to mitigate risk, you’re putting your cash flow at risk and you may not be approved for trade credit insurance in the future, should you choose to seek it.

You can carry out this process yourself or employ the services of a credit reference agency.

A credit reference agency will gather and assess essential information on a potential customer, delivering a full credit report. This credit report will provide in-depth details about the business's credit score and payment history, helping you determine whether there have been any previous defaults and to assess the business's financial health.

Depending on the results of this check, a credit reference agency will determine whether a business is legitimate to work with.

While you are free to offer an illegitimate business trade credit, you should be aware that it presents a higher probability of default and will impact your access to mitigating solutions such as trade credit insurance. They may also identify any illegitimate, fraudulent prospects (more on how to identify fraud later).

What are the best practices to manage credit risk?

Unfortunately, offering trade credit to a legitimate business does not ensure that they will pay on time. Here are seven measures you can take whilst selling on credit to reduce potential credit risk:

Apply for trade credit insurance

Following your pre-checks, you may wish to take out trade credit insurance. This ensures that, if a customer fails to pay, you’ll be reimbursed up to 90% of the invoice sum. Not only this, but trade credit insurance underwriters are particularly astute when it comes to assessing the financial strength of a business. If your policy is approved, that’s a vote of confidence in your customer.

Send your invoices in a timely manner

Always ensure that invoices are sent over within 30 days to stop any issues arising around payments. The sooner you send your invoice, the lower your overall credit risk is. Make sure you’re in the habit of invoicing immediately.

Reminder notice

If you have not already received payment, send a reminder letter 7 days before the agreed-upon date. This means the business has had every opportunity to point out if they are unhappy with the service/goods or didn't receive the invoice.

Read receipts

Read receipts on emails are very useful for proving that an agreement you sent was read or that an invoice was received. It's beneficial to have as much information as possible, such as knowing an email you had sent was read.

Stay professional

Make a professional call to their office. During the call, be firm, remember to state the facts, and identify specific payment terms and times. Reading someone's reaction over the phone is much easier than by email.

Appointments

If the amount owed is significant, make an appointment with the customer and collect the funds. If they respond that the funds are not immediately available, keep the appointment and discuss specific payment terms and times. Face-to-face encounters are more effective as it is much harder for someone to lie when you meet them.

Collection agency

Unfortunately, you might experience a situation where your customer refuses to acknowledge your communication. In this case, it's best to involve a reputable collection agency to represent your company professionally.

How to spot fraudulent requests for credit

While you may take all the precautionary measures you can, it is still possible to be caught out by short firm fraud. Short firm fraud involves setting up a temporary company, establishing a good credit history to gain trust, and ordering large quantities of goods or services on credit, only to disappear without paying.

To avoid being stung by fraudulent companies like this, there are tell-tale signs you need to be aware of:

- The only contact made is through mobile phone, with no alternative landline number provided

- The business has a professional-looking website, but it has little functionality

- The buyer has shown no interest in prices and has not attempted negotiation

- The buyer has contacted you, placed an order and requested delivery in an unusually short time frame

- A one-off low-value order or following payment of several low-value orders, a one-off, much larger request

- The buyer has requested to collect their order themselves, often in unmarked vehicles, or asked to change the delivery address at short notice

- The buyer is in a different trade sector than yours and is immediately prepared to supply information such as trade references, accounts, etc.

- The registered office addresses are PO Box addresses or serviced offices

What if, despite your best efforts, a customer defaults?

This is where trade credit insurance comes in. If a customer cannot repay their credit, whether due to insolvency or cash flow issues, a trade credit insurance policy means you will not be left to absorb the fallout of bad debt.

The insurance provider can reimburse a substantial percentage of the amount owed, providing you with a financial safety net that helps cushion the blow and maintain business stability.

The most significant advantage of trade credit insurance is that it allows your business to grow while taking the stress out of onboarding new customers, as you can rest easy knowing you are protected.

Trade Credit Insurance Solutions from PIB Insurance Brokers

While it can be hugely beneficial for a business' growth and success, offering trade credit also poses significant risks.

At PIB Insurance Brokers, we believe that you shouldn't be penalised for another business' faults. Trade credit insurance policies are designed to safeguard you from fraudulent or struggling businesses, covering between 75-95% of your invoice sum.

To find out more about how trade credit insurance allows you to invest in your business growth confidently, don't hesitate to contact our team today.