Business Interruption Insurance

Business Interruption insurance, also known as BI, is a much-misunderstood cover which can often be overlooked by small business owners.

Many business owners are under the impression that their buildings and contents policies will cover all expenses they have lost, should their business suffer a loss from events such as floods, break ins or fire.

We don’t want you to have questions to be asked about the loss of income and what legal rights you have once your business is interrupted. We will breakdown the amount of money you can claim for the interrupted work period. Employers often think the cost of interrupted business is covered on their businesses insurance. It’s important to make sure you have the right insurance for every claim you could need to make, this is made simple by our categorised insurance options.

Whilst buildings and contents insurance provide cover for the initial damage, they do no not provide cover for loss of profits/ revenue or increased costs of working incurred whilst the damage is being repaired. For many business owners without BI cover, what could start off as just a period of business interruption can soon develop into business termination and financial difficulties.

It is common to arrange business interruption cover as part of a commercial package policy, Directors and Officers Insurance can also be useful if the business command line is interrupted.

Protection for Your Business

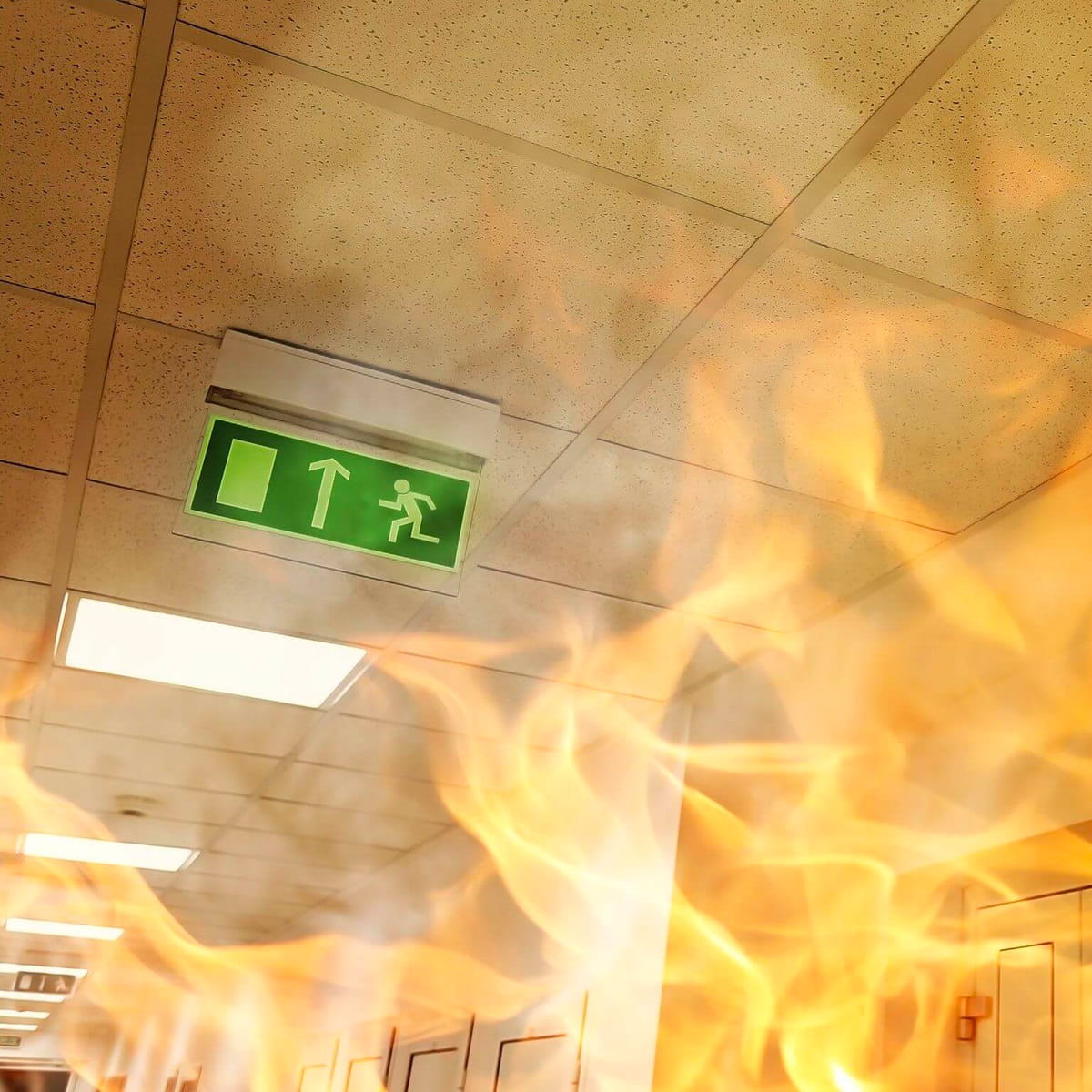

There are many different causes resulting in a material damage and consequently your business being interrupted, examples include fire, flood, impact, explosion, and water damage. However, ultimately any insured peril that gives rise to a material damage claim will take effect. Nobody expects their business to be affected by a disaster such as fire, but if and when they are affected, you cannot simply rely on other policies to cover the losses.

In the event of a catastrophe, it is not always simple to replace stock or even equipment, however the premises may take much longer to be deemed safe to use, specialist tools can take a longer time to replace and before you know it, your business is being interrupted for a substantial amount of time. Perhaps even months go by where your business can’t operate as usual. In a long term period like this, it’s vital that your legal claim will pay enough to support you in getting the premises back to a safe work condition.

Business Interruption Cover

Business interruption policies cover the financial losses which are a direct consequence of an insured peril under the material damage section of a policy. This can include loss of revenue, loss of rental income and increased costs for staffing. This insurance is often had in collaboration with public liability insurance. It is important to consider business interruption insurance as part of a commercial package policy, no matter what size your business is.

If you still have questions about what insurance is best for reducing your companies loss of income, feel free to get in contact with our team.

Latest news, industry insights and events

-

The Overlooked Risk: Environmental Liability in the construction sector

-

Sunny Side Up: What Holiday Parks Need to Know About Photovoltaic (PV) Solar System Insurance

-

Why business owners directors and key managers should care about liability protection

-

In the spotlight – Arif Sarwar